Lets learn how to claim it. Check that the GST column total matches the Your payment refund amount on the BAS excluding any PAYG amounts.

How To Get Gst Tax Refund Before Leaving Singapore Changi Airport Or Cruise Terminal Understand What Is Gst Sal Singapore Changi Airport Singapore Travel Tips

Answering a question in the Rajya Sabha on the imposition of 5 GST on common use items like curd paneer jaggery sugar honey lassi rice flour and bread Union Minister of State for Finance.

. We work out the excise refund on the quantity of fuel you purchased not the cost of the fuel. Check the GST totals. View All Featured Posts.

GST or the goods and service tax is a comprehensive multi-stage and destination-based tax levied on every value addition. Advance ruling cannot be given on applicability of GST on Donation. Travel Credit Cards.

HPs ink cartridges and printheads are warranted to be free from defects in materials and workmanship during the period of the warranty. The Integrated GST Act enacted five years ago provides for refund on goods. Recent Updates In GST till 23rd August 2022.

Mandatory E-Filing of Form 10F Needs Reconsideration. Penalty for wrongfully charging GST rate charging. Provisions of Benami Act to be implemented prospectively.

Central Goods and Services Act 2017. You also need to issue GST invoices. West peninsular Malaysia shares a land border with Thailand and there are two bridges that connect Malaysia to the island of Singapore and has coastlines on the South China Sea and the Straits of Malacca.

Rs 25 Respective State Goods and Services Act 2017 or Union territory Goods and Services Act 2017. You also need to issue GST invoices. If youre a GST-registered business you must add GST to your prices.

You can claim a refund of the GST and excise included in the purchase price of alcohol tobacco and fuel even if your tax invoice is for less than 200 including GST. GST is imposed on. Read from the list of frequently asked questions about refunds related issues and get support on refund for a cancelled ticket.

This warranty pertains to the product when used in its designated HP or authorized OEM printing device. The Ministry of Finance MoF announced that Sales and Service Tax SST which administered by the Royal Malaysian Customs Department RMCD will come into effect in Malaysia on 1 September 2018. Clause 44 of Tax Audit Report Breakup of Expenses with.

A GST registered entity who makes zero-rated supplies is able to claim the input tax paid on purchases. No penalty as such. No Claim BonusDiscount Available in the form of a refund in premiums either in full or partial.

Name of the Act Late fees for every day of delay. If youre putting in a claim of RM5000 for the cost of your car repairs due to an accident youll need to pay RM200 and the insurer will pay the remaining RM4800. When a GST Registered business fails to file GST Returns by the prescribed due dates a prescribed late fee.

Be aware that you can only claim your tax refund for a previous tax year within three years of the original tax returns due date or deadline. Working out GST is simple maths. Working out your GST refund or payment.

In the Accounting menu select Reports. Review the transactions for errors. Copy of your most recent drivers license.

GST law applies as a single domestic indirect tax law for the entire country. Understanding The Facts And Figures More articles Housing Loan. Get the best cashback credit cards in Malaysia for instant savings.

GST is not chargeable on exempt supplies of which there are two categories sale and lease of residential land. It can also be a discount on your premiums if you decide to renew your. Original copy of the police report.

Pay the correct GST and get a refund of the wrong type of GST paid earlier. Learn more at goIndiGoin. Rs 25 Total late fees to be paid per day.

Here are the documents required for car insurance claim in Malaysia. But interest 18 on shortfall amount. Rs 50 The law has fixed a maximum late fees of Rs 10000 up to May 2021.

Click the GST Audit Report tab. Claiming back GST and input tax credits GST-registered businesses can claim back the GST they pay on business expenses. Lets learn how to claim it.

The move of scrapping the 6 GST has paved the way for the re-introduction of SST 20 which will come. General Information on GST Return Late Fees. Claiming back GST and input tax credits GST-registered businesses can claim back the GST they pay on business expenses.

Further the GST has replaced many indirect taxes such as excise duty value added tax VAT service tax etc. The scope of GST is provided for under Section 7 of the GST Act. Penalty for delay in payment of invoice.

Working out GST is simple maths. Sales and Service Tax SST in Malaysia. Exports of goods and provision of international services are mainly zero-rated supplies.

It came into effect from July 1. If youre a GST-registered business you must add GST to your prices. Copy of your MyKad.

ITC will be reversed if not paid within 6 months. According to the GST Legislation a late fee is an amount imposed for late filing of GST Returns. 31 GST on the Supply of Goods and Services in Singapore 311 For GST to be chargeable on a supply of goods or services the following four.

For all other back taxes or previous tax years its too. Malaysia is a country in Southeast Asia located partly on a peninsula of the Asian mainland and partly on the northern third of the island of Borneo. HP will at HPs option either refund the purchase price or replace products that prove to be defective.

For example you have until April 15 2024 to claim a 2020 Tax Refund April 15 2023 to claim 2019 Tax Refund and for 2018 until April 18 2022. 1 the supply of goods and services in Singapore and 2 the importation of goods into Singapore. According to a report in The TOI the government will soon begin a pilot to refund goods and services tax GST paid by foreign tourists visiting India as part of a move to implement a measure that is there in the statute.

Working out your GST refund or payment. Penalty for incorrect filing of GST return. Once you are happy with the BAS figures publish it in Xero.

Guide To Tax Refund In Malaysia Bragmybag

Claiming Your Gst Refund As You Leave Malaysia Trs Economy Traveller

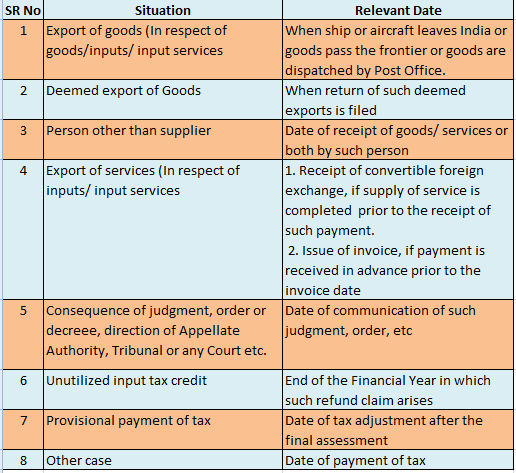

Refund Under Gst All You Need To Know Quickbooks

Guide To Tax Refund In China Bragmybag

A Quick Look At Tax Tourist Refund Schemes Economy Traveller

Refund Process Under Gst Easy Gst

Guide To Tax Refund In Malaysia Bragmybag Tax Refund Bags Bags Designer

A Complete Guide On Gst Returns On Exports Refund Process

Guide To Tax Refund In Japan Bragmybag

Allow Nris Foreigners Buying Gold To Claim Gst Refund On Their Return

Claiming Your Gst Refund As You Leave Malaysia Trs Economy Traveller

How To Claim The Gst Refund For The Things Purchased If I Come To India As A Tourist Quora

Working Out Your Gst Return Gst Guide Xero Sg

Guide To Gst Refund In Australia Bragmybag

How To Collect Gst Tax Refund Eztax

How To Get Gst Refund Indiafilings

Finally Gst Goods And Services Tax Bill Has Been Passed In Rajya Sabha India We Would Be Hel Creative Advertising Goods And Service Tax Creative Branding

Filing Of Gst Return Video Guide Youtube